Our contributor, Blair C., was tasked to chat to her 10 year old son Zach about tax and super. Here she shares her tips on how to broach this topic with your kids:

Gauge what they know

I started out asking my 10 year old son if he was willing to sit down and have a conversation with me about tax and super, he said “yes” with a confused look on his face.

Mum – “Do you know what tax and super is?”

Zach – “NO!”

I left it for a few days to figure out how I was going to approach such a topic in a way, which my son at the age of 10 would understand.

Find kid-friendly resources

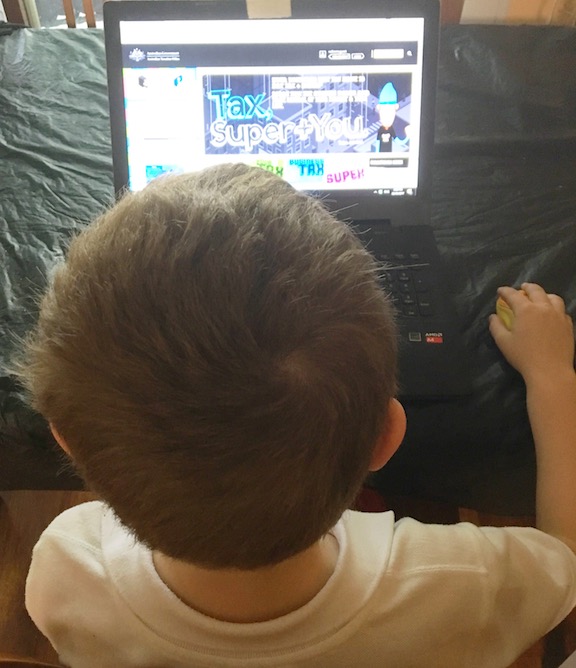

Thankfully the ATO has a wonderful website https://www.taxsuperandyou.gov.au/ that can help parents and carers with information to help have these conversations with children. I thought it would be best to show my son this website as well as write a list of things that without tax or super, would not be possible to have in Australia, such as:

- Public and private schools

- Police, fire and ambulance services

- Hospitals

- Roads and trains

- Parks and playgrounds

- Medicare

These are just a few of the examples I used to explain to my son why we pay tax and where it goes to within the community.

Simplify it

I explained that each year the government sets a budget and gives out a certain amount of money to each of the above items that we spoke about. Zach was very surprised that tax goes to help pay for all the items he has used himself.

Use everyday examples

I also got out a receipt from a shopping trip we did together and showed him that we also pay tax on certain items that we buy, like food, clothing and toys. He immediately asked if that meant he paid tax on the Lego he bought with his pocket money? Yes he does!

I thought Medicare would be another good example we could discuss. I got out my Medicare card and asked my son

“Do you know why I get this card out every time we go to the doctors?”

I explained that because of taxes, we have a fantastic medical system that pays for our visits to the doctors and hospitals.

Take a break

At this point I knew he must be experiencing a bit of information overload! So we had a break and played a little bit of PlayStation. This is a big topic for adults, so imagine what it’s like for kids to understand.

Later that evening we sat down again and I asked the question

“Do you know what superannuation is?”

I got a very confused look. I proceeded to ask him what he thought happened once people finished working.

Mum – “How will you get money once you stop working?”

Zach – “From your kids!”

If only that was the case!

I explained to Zach that each week when you get paid, a little bit of your pay would go into a separate account called “super” and when you reach a certain age you can access that account as this money will help you live your daily life after you’ve stopped working.

Zach – “That’s such a great idea!”

Check in

For a child his age, I knew that was enough information for him to gain a basic understanding of tax and super. While I know that these are topics that he will learn at school or when he gets his first job, I also believe that it’s important for parents and carers to support kids in getting a good understanding of tax and super as it plays such an important role in everyone’s life.

To finish off our discussion, I asked Zach what he thought about what we talked about today

Zach – “…well it sucks that you have to give up money that you work for, but I guess you do get a lot in return!”

My sentiments exactly!